The collapse of Silicon Valley Bank and Signature Bank has had a profound impact on the Federal Reserve’s decision-making process regarding interest rate hikes. The collapse of these banks, coupled with broader international financial instability, has added complexity to the decision-making process of the Federal Reserve.

The Federal Reserve announced a 0.25% increase in the federal funds rate based on recent indicators showing moderate growth in spending and production, strong job gains, and low unemployment rates. However, inflation remained elevated at 6.0% as of February 2023. During the pandemic-induced recession, interest rate targets were set between 0.0% and 0.25% to stimulate economic activity, but they now range between 4.75% and 5.0%.

The primary purpose of rate hikes is to reduce inflationary pressures by increasing the cost of borrowing money, leading consumers and businesses to take on less debt. However, the collapse of Silicon Valley Bank and Signature Bank has made the decision to hike interest rates more complex. The collapse of these banks has made it clear that financial stability must be taken into account when making such decisions.

The collapse of Silicon Valley Bank forced the bank to sell a bond portfolio at a loss due to the higher interest rate environment. This, in turn, caused account holders to withdraw their funds, which had far-reaching effects. Despite this, the Federal Deposit Insurance Corporation insured all accounts to prevent bank runs at other firms.

The Federal Open Market Committee believes that the financial system is resilient but recognizes that recent developments are uncertain and could have far-reaching effects. One study suggests that the Federal Reserve’s more restrictive monetary policy has caused bank assets’ value to decrease by 10%, making banks more fragile to runs from uninsured depositors.

The Federal Reserve has been cautious about raising interest rates due to concerns about how this could impact economic activity, hiring, and inflation. The collapse of these banks adds to these concerns, making the decision to raise interest rates more difficult.

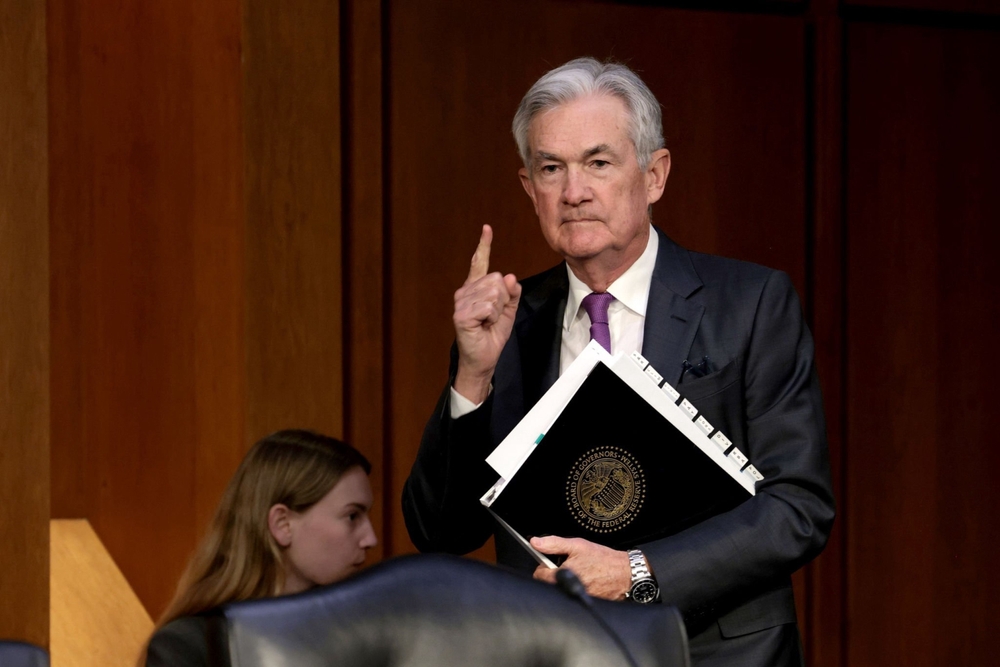

The Federal Reserve Chair, Jerome Powell, has stated that the robust labor market and persistent inflation in certain areas mean that policymakers will gradually increase target interest rates. However, household wages have declined over the past two years, even with low unemployment rates. This highlights the need to consider the broader economic implications of interest rate hikes.

The collapse of Silicon Valley Bank and Signature Bank has also highlighted the need for increased regulation and oversight of the financial sector to prevent future collapses. The Federal Reserve and other regulatory agencies must work together to ensure that the financial system remains stable and resilient.

Furthermore, the collapse of these banks has had a ripple effect on other financial institutions, causing uncertainty and instability in the broader financial system. This underscores the need for the Federal Reserve to carefully balance the need for financial stability with the potential impact on economic activity, hiring, and inflation.

In conclusion, the collapse of Silicon Valley Bank and Signature Bank, along with broader international financial instability, has added complexity to the Federal Reserve’s decision-making process regarding interest rate hikes. The Federal Reserve must carefully weigh the need for financial stability with the potential impact on economic activity, hiring, and inflation. Additionally, increased regulation and oversight of the financial sector are necessary to prevent future collapses and ensure the stability of the financial system.